How To Save Money on a Family Vacation to Hawaii

It’s no secret that a trip to paradise can be expensive. We’ll explore the best tips for saving money on your Hawaiian vacation for budget-friendly fun.... Read More

Property Management Tips To Build Generational Wealth

Feel empowered as a property owner building generational wealth with actionable advice on increasing property value by prioritizing upgrades and tenant safety.... Read More

Financial Planning for Parents: Securing Your Child’s Future

Financial planning takes on a special significance when you’re a parent. Black mothers face unique challenges in parental financial planning, like systemic inequities and disparities in wealth accumulation, that magnify... Read More

New or Used: Determining Which Car Is Best for You

When you’re in the market for a new vehicle, the choice between new and used is quite heavy. As a busy mom, you need a reliable car, especially one that... Read More

Creating Generational Wealth as a Black Mother

As Black mothers, we have the unique and powerful opportunity to build financial legacies that can last for generations. For many of us, this journey begins with understanding the principles... Read More

Early Prep Steps for Next Year’s Tax Season

Preparing for tax season is a big undertaking, especially for families looking to get ahead or build a nest for the future. It’s vital to start early and ensure that... Read More

4 Easy Ways To Save Money on Your Child’s Birthday Party

These days, it’s easy to feel the pressure of having to throw the perfect birthday party for your child. With social media showcasing elaborate celebrations, it’s no wonder many parents... Read More

The Pros of Opening an IRA Account for a Child

In our family, we try to pass down important knowledge, wise lessons, delicious recipes, and engaging stories. The tradition of passing down generational wealth and financial literacy to help set... Read More

The Good, The Bad, & The Ugly of Student Loans

I have a love hate relationship with my student loans. I hate that they are so much (almost 6 figures), I hate that the payments prevent me from traveling, and... Read More

15 ways I cut our grocery budget in 1/2

As a mom of 3 growing boys and 1 hungry husband, the amount of food we have to keep in this house is insane. Over the years, there were... Read More

The 30-Day Guide To Debt Freedom Workbook

When I began this process, I was clueless about where to start. I listened to podcast, read books, took financial courses, read articles, subscribed to personal finance blogs, practically everything... Read More

6 Tips to Creating 2021 Vision Boards That You Will Stick With

The beginning of not only a new year, but a new decade is the perfect time to set annual goals. You should set goals for every area in your life;... Read More

How To Recover From Overspending During The Holiday Season

Now that the holiday season is over, we are left with all of the financial scars of being “Santa” because you may or may not have read my blog How... Read More

I Paid Off Over $30,000 of Debt in 12 Months And Here’s How

I paid off $32,295.30 of debt in 12 months!! I began this journey in $118,069 of consumer debt. This debt included several credit cards, medical expenses, 2 auto loans, 2... Read More

Ultimate Guide to Avoid Overspending During the Holidays

Christmas is right around the corner and everyone knows Christmas is the time of giving. The “giving spirit” can sometimes cause us to overspend, therefore leaving us in debt. But... Read More

When my mother died without a will, I learned a big lesson about money management as an African American

ORIGINALLY POSTED ON THE BUSINESS INSIDER Angie Chatman Sep 9, 2019, 11:09 AM My mother purchased her home on the south side of Chicago for $55,000 in 1986, the equivalent... Read More

My Top Two Financial Tips

There are many money lessons I’ve learned along this journey. Out of the many lessons, there are two tips that not only help me to be more financially responsible, but... Read More

Sis, Don’t Let Your 2019 Goals Become Your 2020 Goals

How committed are you to the goals you set in January? 2020 is in 6 months, what have you accomplished? I'm here to encourage you to finish the year strong.... Read More

We Are Trippin’!

An Open Letter to Myself The most dangerous gift in the world is natural talent. You’ve seen it before. It’s the college roommate who partied until 3 AM, never went... Read More

Teaching Kids the Value of Budgeting

Unfortunately money doesn’t grow on trees. I really wish it did. Because of this painfully obvious fact, when you have a large family like ours, budgeting is necessary. Turning homeschool... Read More

Paying the Toll on the Road to Financial Freedom

Financial constraints and bad debt are huge stressors and sleep deprivers for many people. This kind of stress is never short lived. It goes on and on and prevents people... Read More

My Strategy to Paying Off $92,000 of Student Loan Debt

Ok, so I know you’re wondering, how do I plan to pay off $92,000 and how long it will take me? Well, my plan is to pay off my student... Read More

Your Last Minute Tax Guide

As much as we dread April 15th that day comes around every year like clockwork. The moment of truth is less than one week away. Have you procrastinated this year... Read More

Securing our Legacy Part III: Preparing Our Children to Manage Generational wealth

Although I did not grow up in poverty, I also wasn’t born into wealth. My husband jokes all the time about how I grew up “rich”, which couldn’t be further... Read More

Securing Our Legacy Part II: Generational Wealth

We are talking about building wealth, therefore having only one source of income will not cut it. Take all of your eggs out of that one basket and start spreading... Read More

My Strategy to Pay Off $92,000 of Student Loan Debt

Ok, so I know you’re wondering, how do I plan to pay off $92,000 and how long it will take me? Well, my plan is to pay off my student... Read More

From 6 Figure Chick to Stay At Home Mommi

I was one of those lucky people who always knew what I wanted to do. It wavered once or twice as far as my career choice, but was always my... Read More

Securing Our Legacy, Part I: Who’s Going to Teach Our Children About Generational Wealth?

Hey Mommies, I want to take a moment to discuss a very serious topic. A topic that the success of our children, future grandchildren, and even our Nation depends on.... Read More

Student Loan Mistakes That I Made That You Should Avoid

I’ve made many mistakes in my short 32 years on this earth, but when it comes to student loans, I’ve really outdone myself. Let’s recap Part I of this series... Read More

I Have $92,000+ in Student Loan Debt

Have you heard the recent student loan debt statistics? According to Forbes, Student loan debt is now the second highest consumer debt category (2nd only to mortgage loans) and higher... Read More

10 Things You Are Forgetting In Your Budget

Budgeting is all about making a plan for your money. Forgetting to budget 1 thing could destroy your entire budget and set you back for months. Here is a list... Read More

Reducing Expenses

Did you know that you could negotiate your expenses? I asked this question on my Instagram account and I received so many questions about how. How much are your monthly... Read More

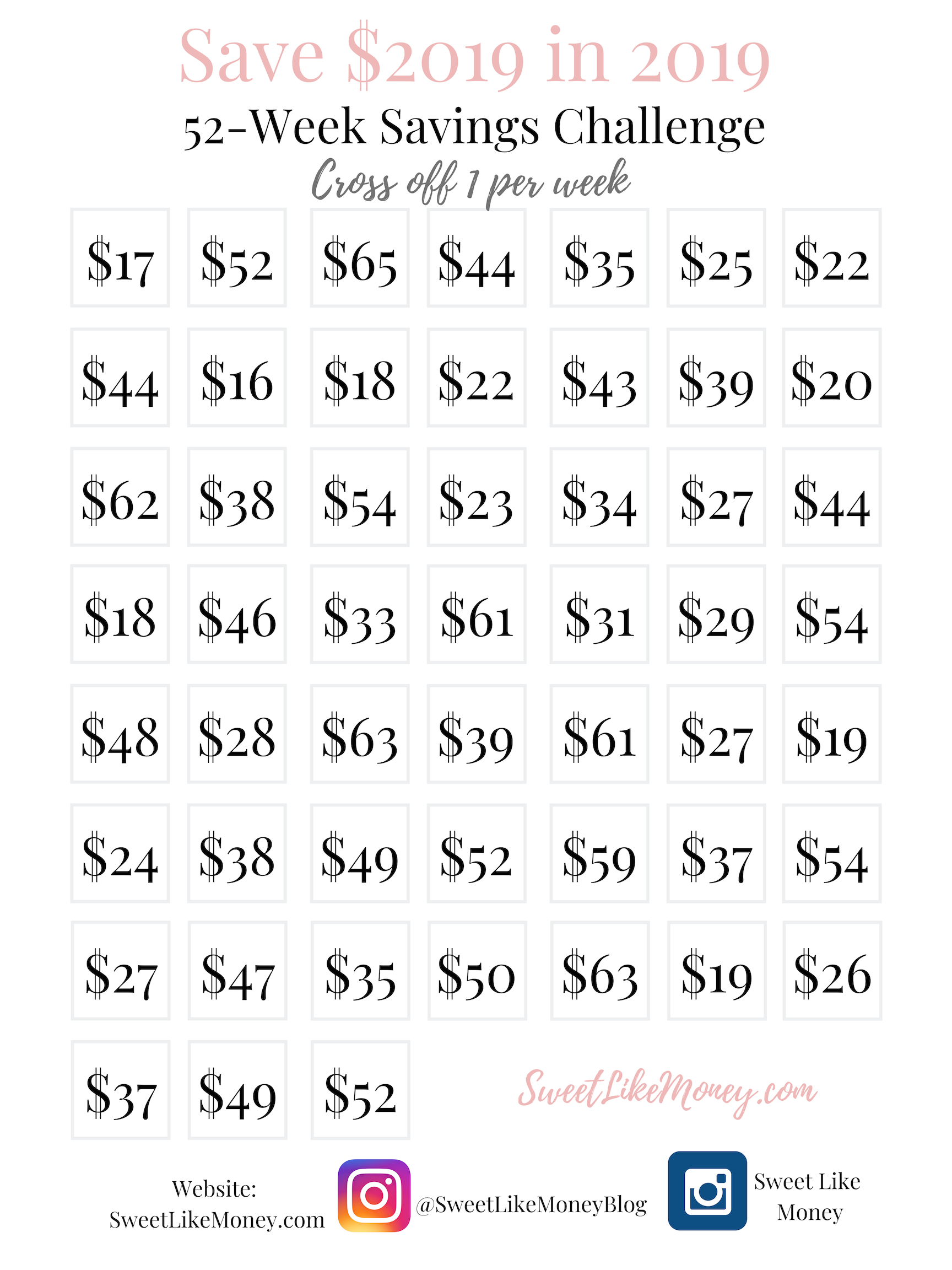

Save $2019 In The Year of 2019 – Sweet Like Money Savings Challenge

Sweet Like Money Savings Challenge It’s that time of year again! It’s the time of year when we make our annual financial goals. Saving is probably at the top of... Read More

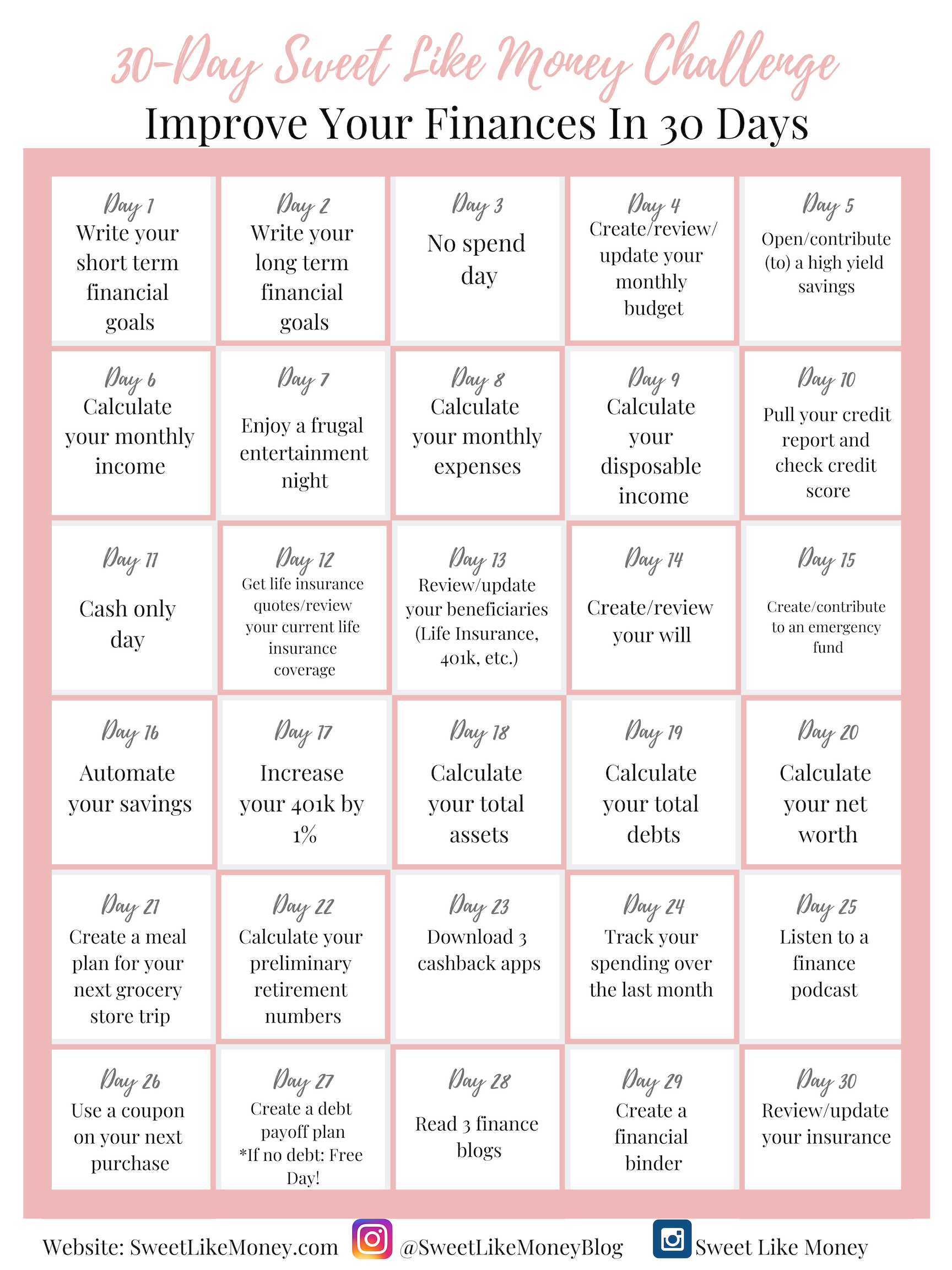

Sweet Like Money Challenge

Improving your Finances Assessing your financial health is essential. In order to successfully improve your finances, you have to know your current financial health. There are several factors to assessing... Read More

The 6 Essential Steps to Creating a Budget

Do you find yourself asking, “where has my money gone”? Are you constantly waiting for the next paycheck, month after month? Do you struggle finding money just days before your... Read More